top of page

Accounting and Tax Advisory

Our company's main accounting services include:

Using our accounting services can bring your company:

Continuous and stable service: Avoid manpower vacancies caused by personnel turnover and various employee holidays, avoid the need for clients to adjust to new employees, and reduce the time and effort clients put into recruitment.

High-quality professional services: Our management team is a registered accountant with professional qualifications. With a customer-oriented service spirit, we are committed to providing professional, reliable and confident quality services to every customer.

Improve cost-effectiveness: As a company that mainly provides accounting services, our advantage lies in our ability to effectively control costs and provide customers with preferential accounting service solutions, so that customers can get the necessary support without having to hire a full-time accountant.

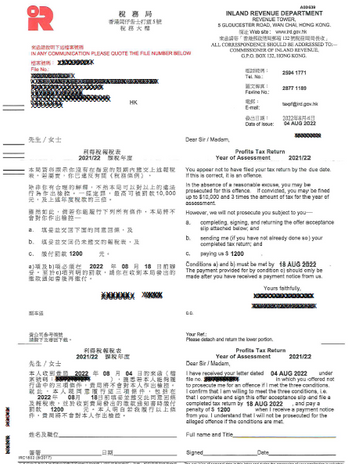

Hong Kong Taxation for Corporation

According to the Inland Revenue Department's website, any person, including corporations, partnerships, trustees or bodies of persons, carrying on business in Hong Kong and deriving assessable profits from such business arising in or derived from Hong Kong (except profits from the disposal of capital assets) is subject to tax.

For newly established limited companies, the Inland Revenue Department will generally issue the first Profits Tax Return 18 months after incorporation. Submission is usually limited to three months. Late submission will result in a fine (usually HK$1,200 for the first offence; HK$3,000 or more for subsequent offences), estimated tax assessments, and even court summonses.

Our company's main tax services include:

1. Provide consultation on Hong Kong taxation, including profits tax, salaries tax and property tax

2. Hong Kong tax declaration, including filling in tax returns and submitting them to the Inland Revenue Department, and assisting in answering questions from the Inland Revenue Department

3. Hong Kong Identity Card application (individuals and companies) and related consulting services, such as business model planning

4. Advice (Company), Work Visa Application (Individual), etc.

Whatsapp:

(852) 5592 0208

Telephone:

(852) 2312 2733

Monday to Friday

9am to 6pm

bottom of page